As we approach each new season on the calendar, you may not be in the same season in your life. You may be in spring (things are starting to grow and blossom in your life), summer (things are in full bloom and growing like crazy), autumn (things have reached their peak and you are reaping the rewards) or you are in winter where things are dying and you are starting to hibernate. We see winter as a scary time, we wonder if we will ever see the spring again, but as the seasons on the calendar always change so will the seasons of your life. No matter what aspect it is, your finances, your … [Read more...]

Time Is On Your Side

The title to the popular Rolling Stones song "Time Is On My Side" can be applied to saving money. The best ally you have is the length of time that you are investing and your investments are growing. Once you reach the tipping point the growth becomes even faster. For example: A 30 year old makes $75,000 a year and puts away 10% of her income a year. She receives a 3% raise each year but keeps putting away 10% and gets 6% a year in returns. It will take her 31 years to get to 1 million, but only 10 more after that to get to 2 million. Action Step for You: Start investing … [Read more...]

What Price are You Willing to Pay for Your Future Success?

Dental CEO's, how much time and money do you spend on your personal development? I am not talking about going to the gym; I mean books, CDs, podcasts, seminars, etc. “Why Mario, I don’t spend a dime! I can’t afford the time or the money.” This type of thinking will surely lead you to a mundane life. How will we ever get any better at saving and making money, raising kids, at your profession, your mental health or finding your mission in life unless you take the time to invest in yourself? Try subscribing to magazines like Success, Money, Inc., instead of People, Us and Glamour. During my … [Read more...]

How Rich People Think: Wealth Management for Dental CEO’s

Dental CEO's, did you know your wealth is 80% Psychology, 20% Mechanics? Like many of you I always used to think, “just please tell me where I should put my money, what investment should I hold or what stock should I buy.” What I have learned over the years is that the psychology of wealth is way more important than the mechanics. That is why 80% of the thoughts in this section are psychological in nature and about 20% are the mechanics. I know you might think it’s boring, but those who don’t are the ones with all the money. Here is a thought, “Most people think about spending, wealthy … [Read more...]

Make Your Haters Your Raving Fans!

How many times have you gone to a store or restaurant without many high expectations, and then, not to your surprise, they made a mistake that angered you? You were prepared for a battle to correct it and instead you were pleasantly surprised at how the company handled your complaint. It was done without hesitation and it far exceeded your hopes. Suddenly you found yourself talking about this company to your friends in a positive manner. 95% of unsatisfied customers never take time to complain (this gives companies the illusion that they are providing excellent customer … [Read more...]

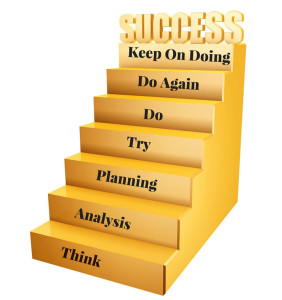

Seven Step Method to Achieving Your Goals

We all have goals of some sort, but why do some people always seem to achieve their goals consistently while others fail regularly? Here is a seven step method from Brian Tracy to try and help you win every time. Decide exactly what you want (Know your outcome!) Write it down. This step increases your chances by 80%. Set a deadline for your goal. Have a target date. Make a list of every possible thing that you can do to achieve your goal. Then make a list of what might get in your way. What people can help you get there? Organize your goal by sequence and priority. What … [Read more...]

How To Reach One Million Dollars!

Some of you might be thinking, “There is no way with my current job or plight in life I can accomplish one million dollars!” Yes you can!!!! It is a process, but there is a method and here are some tips! Live below your means! Spend less than you make! Any raises or bonuses that you receive, spend half but save the other half in a bank account or investment you do not touch. Do not purchase a “keeping up with the Jones’” home. Warren Buffet lives in the same $31,500 home he bought in 1958. If you are not getting paid what you are worth, ask for what you are worth or move on to … [Read more...]

The Benefits of using Social Media for your Dental Practice

Be a Social Media Nut!! The days of trying to impress someone by saying “I don’t have a Facebook page” or “I don’t need a website” have quickly become as archaic as plaster impressions. Today more than 85% of the dental practices have a website and just as many are getting involved in some type of social media. It is important not only in new patients finding you, but in keeping your current patients up with what you are doing. It is a free resource you can use. The main goal should be to be the number one name that pops up when someone “Googles” for a dentist in your area. Here is … [Read more...]

Do You Know all of Your Family?

Dental CEO's, how well do you know your family? My three children, my mother, and I recently returned from a trip that took us to 4 countries: Germany, Austria, Slovenia, and my home land Croatia. We encountered incredible scenery and history. However, the greatest part of the trip was visiting and getting to know some relatives we had not seen in over 9 years, some new additions we had never met, and watching my mom converse with people that she had not seen in close to 50 years. Prior to the trip, I had drawn a family tree of who we were going to meet for the kids. I carried around … [Read more...]

Your Midyear Check-Up

We have just completed the first 6 months of the year. Just like a dental checkup every 6 months, you should be checking in on your financial growth. Many of you have financial advisers. Have you gotten a report from them showing all of your investments and how they have performed so far this year? Have you checked in on how your spending is doing so far this year? I recommend you treat your personal finances like your business. I keep track of all my spending at home on Quick Books, the same software I use for the office. It is nice to be able to see what I spent year-to-year on … [Read more...]