Should you pay off debt or invest your money? One of the most complex questions of all time in the financial world is, “Do I put all my extra cash and concentration on paying off my debt or do I just steadily pay it off and invest the cash I have?” In Cabo, I finally found my answer. Of course, we all know if you have high interest credit card debt or student loans, it make sense to get rid of all that debt as soon as possible. However, how about the house, car, and student loans that are in the 3-5% range? We will put the psychological question of being debt free aside for the moment … [Read more...]

Is Your “House” in Order?

Are you prepared for the unexpected? Many years ago, the Ohio Dental Association came up with a "survival kit" to help spouses whose dentist spouses had passed away (many times suddenly). They found most had no idea what was involved, who was involved, where the money was, and it created quite a mess. When my brother passed away at the age of 41, I had a spouse and two young children and imagined what a financial (and emotional) mess it would be if something unexpected happened to me. So, at the ripe old age of 30, I had an attorney prepare my: Last Will and Testament Revocable … [Read more...]

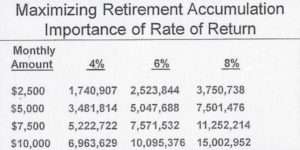

More Secrets to Wealth

Wealth is 80% psychology and 20% mechanics. (You can read more about it here.) Keith Cunningham does a great job going over 7 wealth strategies and I would like to share. Pay Yourself First: The oldest and most proven point to wealth creation (that would include investing). Discipline: Not wanting it all at once, saving, planning. Life Style vs. Wealth Creation: Living a little less expensive lifestyle in order to accumulate wealth. Focus & Freedom: Making powerful habits when it comes to money, focusing on the importance of wealth. Financial Competence: Have some … [Read more...]