Should you pay off debt or invest your money?

One of the most complex questions of all time in the financial world is, “Do I put all my extra cash and concentration on paying off my debt or do I just steadily pay it off and invest the cash I have?”

In Cabo, I finally found my answer.

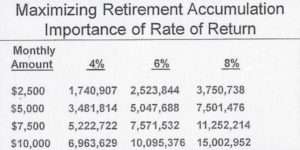

Of course, we all know if you have high interest credit card debt or student loans, it make sense to get rid of all that debt as soon as possible. However, how about the house, car, and student loans that are in the 3-5% range? We will put the psychological question of being debt free aside for the moment and just talk money. Simply put, invest first. Why? Time is the most important asset you have when building your wealth. You must get into the game right away, so open and maximize your simple IRA’s, 401K’s, Roth IRA, or brokerage accounts. Then, use anything extra to pay off your loan interest debt. See the chart for an illustration of how much money you would have if invested of a 30-year span.

Action Step for You: Make sure you are maximizing your retirement plans if you can, no matter what age you are.

Leave a Reply